In recent years, Contract for Difference (CFDs) has emerged as a popular instrument in the world of finance, offering investors an array of opportunities within modern investment portfolios. Let’s delve into what CFD trading are and how they contribute to shaping contemporary investment strategies.

What are CFDs?

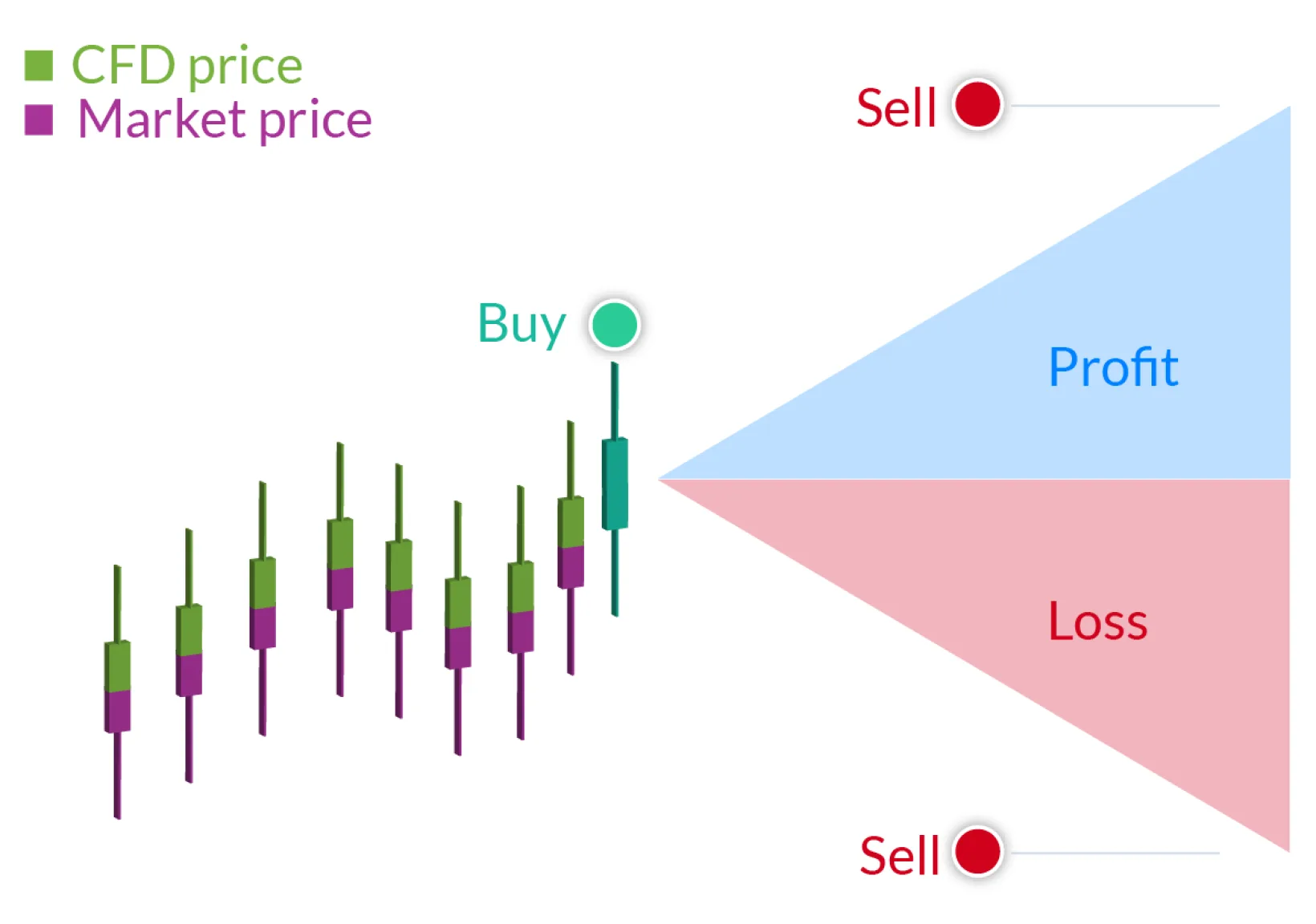

A Contract for Difference is a derivative product that enables investors to speculate on the price movements of various financial assets without owning the underlying asset itself. This includes indices, commodities, currencies, and stocks. Essentially, CFDs allow traders to capitalize on both rising and falling markets.

Flexibility in Leverage

One of the key features of CFDs is their flexibility in leverage. While traditional brokerage accounts may offer fixed leverage ratios, CFDs provide traders with the ability to choose their leverage level, allowing for tailored risk management strategies. This flexibility empowers investors to optimize their positions based on market conditions and personal risk tolerance.

Diverse Investment Opportunities

CFDs offer a diverse range of investment opportunities across multiple asset classes, providing investors with access to global markets from a single trading platform. This diversity allows for enhanced portfolio diversification, reducing overall risk exposure.

Hedging Capabilities

In addition to speculation, CFDs can be used as effective hedging tools within investment portfolios. By taking offsetting positions in correlated assets, investors can mitigate potential losses during adverse market conditions, thereby safeguarding their capital.

Cost-Efficient Trading

CFDs often involve lower transaction costs compared to traditional forms of trading, making them a cost-effective option for investors seeking to optimize their trading expenses. Additionally, CFDs typically do not involve ownership fees or stamp duties, further reducing the overall cost of trading.

Risk Management Strategies

CFDs offer a variety of risk management tools, including stop-loss orders and limit orders, enabling investors to define their risk parameters and protect their capital. These risk management strategies are essential for maintaining a disciplined approach to trading and preserving long-term investment objectives.

Conclusion

In conclusion, CFDs play a significant role in modern investment portfolios due to their flexibility, diverse investment opportunities, hedging capabilities, cost-efficient trading, and robust risk management tools. However, it’s crucial for investors to understand the inherent risks associated with CFD trading and to employ prudent risk management strategies to safeguard their investments. By incorporating CFDs into a well-balanced investment portfolio, investors can potentially enhance returns while managing risk effectively.